India’s Income Tax (IT) department has been issuing advisories to Aadhaar Card holders to link it with their PAN card. The current deadline is 31 March 2023. If the PAN is not linked with your Aadhaar by March 31, 2023, then from 1st April 2023, your PAN will become inoperative. Once your PAN becomes inoperative, you will not be able to file an income tax return and this will also affect the Know Your Customer (KYC) status of your bank account in India.

What is Aadhaar

Aadahar card is a unique ID for residents in India. Non-residents are not entitled to the card, however, if you stay in India for over 180 days, you can apply for an Aadhaar card, irrespective of your nationality. Therefore, OCI holders resident in India are entitled.

If you have an Aadhaar card, obtained before you moved to the UK or after you became an NRI, or issued in error to a non-resident or obtained fraudulently claiming to be a resident in India, it’s likely that your card is linked to your bank account. The banks have been sending emails to such account holders to link it to their PAN card.

According to India’s income tax department, all taxpayers have to link their Aadhaar to their PAN card. But, non-residents are exempted. However, you have to inform the Tax Department that you are a non-resident, by logging into your Aadhaar account.

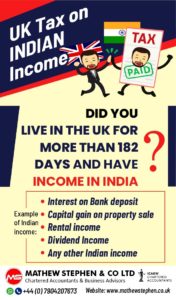

According to Mathew Stephen of Mathew Stephen & Co Ltd, a firm of Chartered Accountants “NRIs are exempted but have to update their status. Otherwise, Pan card will become inoperative from 1st April 2023 if it is not linked with Aadhaar. The Current penalty is Rs.1000, it may increase after 31st March 2023.”

Are you affected? You can contact Mathew Stephen on 07904 207673.

If you do not have an Aadhar card, you don’t need to do anything.