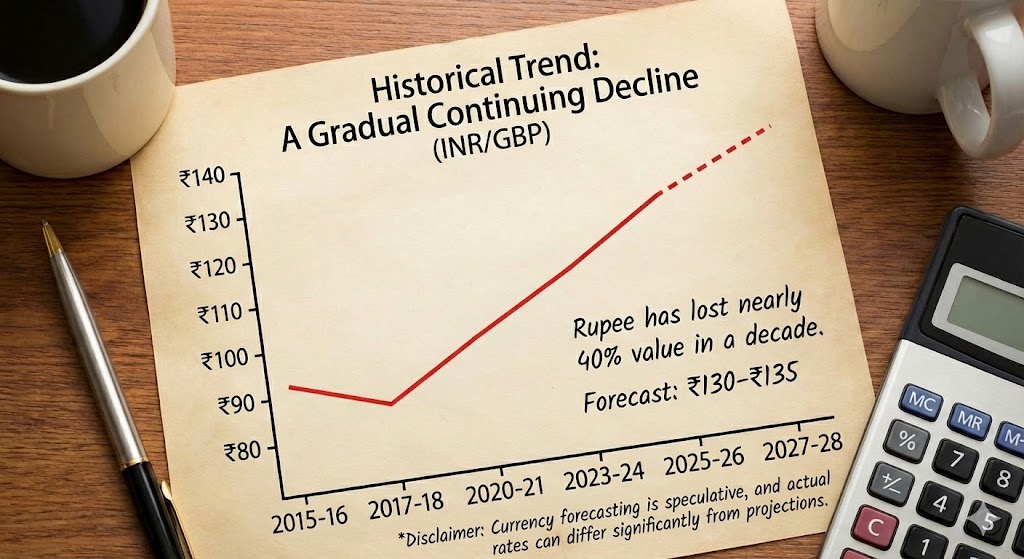

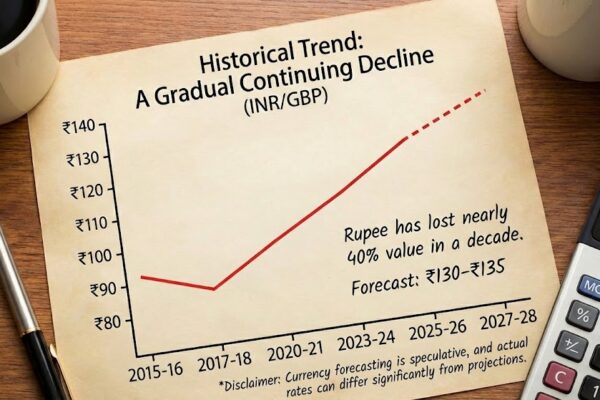

If the trend continues Rupee could reach ₹135 to a pound by the end of the year

The continued weakening of the Indian rupee against major global currencies, especially the British pound, has become a growing concern for policymakers and businesses. At the same time, this trend has brought mixed consequences for Indians living and working abroad.

Over the past decade, the rupee has steadily lost ground against the pound. From around ₹85 per pound in 2016–17, the exchange rate crossed ₹100 in recent years and has now moved into the ₹120–₹125 range. With the rupee now touching above ₹125 to a pound, market observers say currency pressures are intensifying. Based on historical trends and present global uncertainties, some analysts warn that the rupee could possibly slide further and touch ₹135 to a pound before the end of the year if current pressures persist.

Why Is the Rupee Weakening?

Several domestic and international factors are driving the rupee’s decline. Global economic uncertainty, geopolitical tensions, and renewed trade disputes have made investors cautious about emerging markets. The possibility of fresh tariffs and protectionist policies, particularly in the United States, has affected global trade sentiment and weakened export prospects for countries like India.

At the same time, foreign investors have reduced their exposure to Indian markets, leading to capital outflows.

Historical Trend: A Gradual Continuing Decline

The rupee’s weakening against the pound is not a sudden development. It reflects a long-term trend:

-

2015–16: Around ₹90–₹93 per pound

-

2017–18: Around ₹85–₹88

-

2020–21: Around ₹95–₹100

-

2023–24: Around ₹105–₹110

-

2025–26: Around ₹120–₹125

This steady rise shows how the rupee has lost nearly 40 per cent of its value against the pound in about a decade. If this pattern continues, a move towards ₹130–₹135 cannot be ruled out.

*Disclaimer: Currency forecasting is speculative, and actual rates can differ significantly from projections.

Relief for Indian Students in the UK

While currency weakness creates challenges for the broader economy, it has brought relief to many Indian students studying and working in the UK with study loans in India.

Thousands of students who complete their education and move into post-study employment earn in pounds. When the rupee weakens, every pound they send to India converts into more rupees. This enables them to repay education loans taken in India more comfortably, support their families, and build savings at a faster pace.

For many young professionals, the strong pound has become a financial cushion at a time of rising living costs in India.

Boost for Gulf Remittances

The weakening rupee has also benefited Indian workers in Gulf countries such as the UAE, Qatar, Kuwait, Saudi Arabia, and Bahrain. Since most Gulf currencies are linked to the US dollar, which remains strong, remittances from the region have increased significantly in rupee terms.

Families in Kerala and other states receive more money for the same amount sent abroad. This supports household consumption, education expenses, healthcare, and housing investments. Remittances continue to play a vital role in sustaining regional economies, especially in southern India.

Bad News for NRI Savings and Deposits

However, the rupee’s weakness has created serious concerns for many Non-Resident Indians who maintain substantial savings in Indian banks through NRI accounts.

Those who have kept large amounts in rupee NRE and NRO accounts over recent years have seen the real value of their capital fall sharply in foreign currency terms. With the pound gaining strength and the rupee touching ₹125, many depositors have effectively lost nearly 10 per cent of their wealth in sterling terms over a short period.

For retirees and long-term savers who rely on these funds for future living expenses abroad, this represents a hidden but substantial financial setback.

India’s Imports Become More Expensive

Despite some benefits, a weak rupee brings serious risks. Imports become more expensive, particularly crude oil, fertilisers, and industrial machinery. This pushes up inflation and increases the cost of living.

Companies with foreign currency loans face higher repayment burdens. The government also finds it harder to control inflation without affecting growth.

The Reserve Bank of India may need to intervene more actively in currency markets if volatility intensifies.

Outlook: Will ₹135 Become Reality?

Looking ahead, much will depend on global economic conditions, capital flows, trade policies, and domestic reforms. If foreign investment remains weak and global uncertainty persists, the rupee may face further depreciation.

Based on long-term trends and present pressures, some market watchers believe the rupee could approach ₹135 to a pound by the end of the year, especially if global trade tensions and capital outflows continue.

However, strong policy action, improved exports, and renewed investor confidence could help stabilise the currency.

Conclusion

The rupee’s decline against the pound reflects deeper structural and global challenges. While it has provided welcome relief to Indian students and overseas workers, it has also eroded the value of NRI savings and increased inflationary pressures at home.

For many families, especially in Kerala, the strong pound and Gulf currencies continue to act as financial lifelines. At the same time, long-term savers and retirees are being forced to rethink their financial planning. As India navigates uncertain global waters, balancing currency stability with growth will remain a key economic challenge in the months ahead.I

Leave a Reply